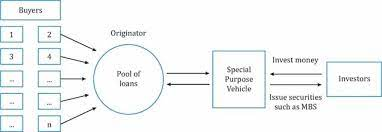

Before analyzing the complex securitization, we must present what securitization is. Securitization follows a specific process where a financial institution (originator) designs a financial product by choosing to group different types of financial items from its balance sheet into a group.

The financial institution then sells this group of financial assets to investors through the issuance of securities. Securitization frees funds and assets from the balance sheets of originators and offers investment opportunities to investors by creating liquidity conditions in the market. Any financial asset can be securitized, thus achieving a high degree of marketability.

by Trust Economics-https://trusteconomics.eu

©The law of intellectual property is prohibited in any way unlawful use/appropriation of this article, with heavy civil and criminal penalties for the infringer.

In the securitization process, the financial institution or company that owns the assets – known as the originator – accumulates assets that for some reason it does not want to keep in its relevant balance sheets. For example, if it were a bank, it might have done so with a variety of mortgages and consumer loans that it no longer wants to service.

This group of assets accumulated is now considered a reference portfolio. The developer then sells the portfolio of that reference portfolio to an issuer who will issue marketable securities. The securities generated represent a portion of the portfolio assets. Investors will buy securities created for a fixed rate of return/risk.

The complex securitization for the provision of loans (liquidity) to companies

Composite securitization is a type of financial technique in which a primary financial institution (e.g., European Guarantee Fund) -originator:

1. Identifies a specific group of existing assets (may be available funds for use other than its own assets) that it has in its assets. This volume (capital / assets) of assets is defined as a portfolio of securities to be securitized.

2. Categorizes specific parts of the specific portfolio of securities to be securitized by attaching to them different risk / return profiles.

3. Transfers part of the risk arising from the specific securities portfolio to securitization through the protection market from another protection seller.

The protection seller (e.g., another financial institution) will provide protection to third-party financial institutions (investors) in the form of a guarantee for a specific risk segment attached to the specific segments of that asset portfolio to be securitized (its segments), while the segments of the portfolio may be a specific number, but since the specific portfolio meets certain requirements concerning e.g. the maximum size and contains only non-performing loans, in this case the entire portfolio is grouped to the maximum and is a single segment.

In exchange for providing a guarantee/protection, the protection seller will charge the third-party financial institutions (investors) with a subsidized guaranteed supply. The originator through the protection seller (second-intermediary financial institution) sells the securities portfolio for securitization (in our case volume of funds for liquidity injections in the market) to the third financial institutions (investors) which in turn will promote these funds with the form of loans (granting liquidity in the market) to a specific category of companies (clients).

The specific categories of companies (borrowers and final beneficiaries of the new product) should comply with the criteria set by the protection seller (financial intermediary) for the provision of these funds/portfolio items to investors (third party financial institutions).

Investors (third party financial institutions) will be required to use funds released through the originator guarantee to create a new set of assets (loans) to meet the liquidity needs of the final recipients of the loans in compliance with a framework of conditions for these loans (the degree of risk, the size of the loan granted, the duration and maturity of the loans granted).

In addition to this commitment, the three financial institutions (investors) will be able to grant additional loans from their own assets.

Users of complex securitization

Composite securitization is commonly used by state or federal government agencies, respectively, to provide loans (liquidity) to specific business categories through commercial banks.

The goal is to free up the lending capacity of commercial banks and to prevent their resources from shifting to lower risk assets instead of loans to a specific category of business.

The financial crisis caused by the Covid-19 pandemic creates a risky environment, where existing commercial banks can accept a downgrade of their existing loan portfolios, and then ask for funds again.

One such product is the provision of loans by the European Guarantee Fund, with the EIB managing the funds provided to small and medium-sized enterprises.