The global financial crisis of 2008, apart from the structural upheavals it has caused to the banking and general financial system of the US and the EU respectively, has led as much the economies as the incomes of overwhelming majority of citizens and businesses to adjust to lower levels of wealth.

This new reality made it very difficult to access businesses and especially new innovative companies (start-ups) in bank financing with a view not only to financial supporting them at an early stage but also to the unimpeded financing of their further development.

by Thanos S. Chonthrogiannis-https://www.liberalglobe.com

The technology of Blockchain and how it gave the expected solutions

But at the same time with the financial crisis of 2008, new technologies were emerging which could be used in all types of applications. One of these technologies emerged from the financial crisis of 2008 onwards is the Blockchain technology that was first used in the digital cryptocurrency Bitcoin of Satoshi Nakamoto giving this technology the necessary solutions and applications in many socio-economic sectors of modern societies.

It has found application in areas such as financial services, energy, services of general common interest, industry, health, education, electoral confrontations with the counting of votes, safeguarding and transparency of historical cultural, fiscal and any type of files in general etc.

According to blockchain technology, it is possible for an unlimited population of people-and regardless the size of population-to be able to participate in the development of a network of connected computers and through this network this population of people to participates in financial transactions and not only, while providing this network with complete security in terms of safeguarding the property of the participants.

At the same time no public type or other type of authority can in any way, as much as it wants, to intervene in the pre-agreed rules governing the realization or not of transactions. All persons/participants of the blockchain technology network, create and share together a common file.

The so-called consent protocol is a constitution of rules that forms the basis for creating and safeguarding this common file. The more compact the syntax of the protocol consensus, the less likely one of the participants to violate the rules.

This common file, to all network participants, can be continuously enriched in chronological order by new participants without giving any participant and owner of this common file the ability to delete data in this.

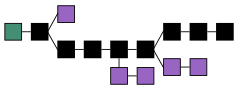

The new advertised documents that cling each time to this common file are then grouped into groups (data blocks) and welded together in time with each other such as the links in a chain (Blockchain) made jointly aimed at the participants of the network.

Photo by Author: Theymos from Bitcoin wiki, vectorization: Own work

licensed, CC-BY-3.0, https://creativecommons.org/licenses/by/3.0/deed.en

Source: Bitcoin wiki: https://en.bitcoin.it/wiki/File:Blockchain.png

The uniqueness of blockchain technology

The ingenious technology of blockchain is based not only on its contribution through its implementation in many areas of actions of modern societies but also on the possibility that the existing areas of action that use this technology-markets/industries to self-regulate and operate on their own without the presence or need of participation of any type of state power or other kind of power.

In fact, Blockchain technology enables it to be fully implemented in any type of service and at any level either local or community or country-wide or globally the liberal policy of Laissez-Faire, Laissez-Passer that promotes trade, growth, culture and wealth of nations.

The terror that causes the state power of blockchain technology

The ability to fully implement laissez-faire, laissez-passer policy by Blockchain’s technology is why it terrorizes the everywhere Governments of the countries of the Earth. For the first time in history the technology of blockchain gives the opportunity to organise in themselves any markets that use this technology, without the need of presence of any state authority.

It is the first time that Laisse’s faire, laissez-passer policy can be perfectly implemented in practice, without the state authorities having the power to intervene and demonstrate that markets can operate without state surveillance. For this reason, all states want in every way to be involved in regulating and controlling users of this technology for protection reasons i.e. as they used to say, to do all types of control to participants, to avoid money laundering, to avoid terrorist financing, ban on non- state-controlled cryptocurrencies and above all for tax collection purposes.

Any state intervention as in the case of the bitcoin ban was made to avoid losing the highest power that states have through their central banks to print and fully control circulation of their currencies-money in their economies. Even though state economic operators know that if in an economy each bank or any other type of financial institution was able to print its own currency, inflation in that economy would always be in low levels independently of the growth rates of the economy.

What is required of any market or industry in its self-regulation for the creation of its secure network is to have strict and compact drafting consent protocols without “holes” that one could use for own benefit. Moreover, since Blockchain technology using a network is a type of open resource code there will be a corresponding transparency.

Alternative ways to finance SME & start-ups through blockchain technology

Blockchain technology has enabled other ways of financing natural and legal persons equally to emerge and beyond the traditional way of banking practice and capital markets, capital markets targeting only large enterprises.

An alternative form of financing of enterprises and particularly innovative enterprises is the issuance by them STO’s (Security Token Οfferings) which are essentially digital securities and which are usually offered by public registration (IPOs-Initial Public Offerings) and by the use of Distributed Catholic Technology (Distributed Ledger Technology) based on Blockchain technology and which we described in a previous paragraph.

The STO’s are securities which represent the debt or share of the issuing SME or start-up. In developed markets such as those in the USA, the STO’s are subject to regulation and legislation which are identical to those applied to traditional financial securities.

The STO’s enable innovative businesses and start-ups to raise funds in a normal and regulated -compliant way while providing greater security against any type of fraud. This feature that give the STO ‘s is extremely valuable when companies have no funding access from the banking sector.

In this way they can seek funding from the local society in which they have their headquarters which under other circumstances should be approached in other larger markets, while helping to develop local businesses by giving work in the local community.

At the same time the STO’s enable investors to sell and buy them, gaining better access to capital, increasing liquidity in the secondary market of STO’s and enabling everyone to acquire a portfolio of these digital securities. The STO’s have as collateral real values.

A start-up or SME company to issue a STO that represents its company’s share should do so with the help of a niche market agents such as STO’s issuance platforms, Exchanges, Custodians, Broker-Dealers, Legal/Compliance.

All these procedures require a specific regulatory framework which so far does not exist on the EU market. Some tentative steps may be taken in France and Germany, but that is not enough when the other EU member countries are lagging far behind on these issues and especially when we are talking about growth that should be based on innovative enterprises.

The EU should make an example of STO’s from other countries such as the UK, USA, Switzerland, Singapore.

Thanos S. Chonthrogiannis

The law of intellectual property is prohibited in any way unlawful use/appropriation of this article, with heavy civil and criminal penalties for the infringer.