The entire European Union is experiencing a growing economic decline – factories are closing or quietly reducing their production.

Chemical industries, steel mills, fertilizer producers – the most energy-intensive sectors of the economy – are either migrating out of Europe or shutting down altogether. This is not a cyclical downturn. It is structural decline.

Europe has not emerged from the energy crisis of 2022 and is not going to emerge anytime soon. The most worrying element is not even the crisis itself, but the fact that the European leadership fails to understand what is happening.

Policymakers recognize the loss of competitiveness, but their response is locked into a faulty economic paradigm. They pursue lower energy prices, almost completely ignoring the costs at the system level.

With an unwavering belief that politics can overcome natural constraints, they simply redistribute the burden of a dwindling energy surplus, masking it with elaborate schemes of “political engineering.” The deeper problem with Europe’s leadership is an energy illiteracy.

A Slow-Motion Suicide

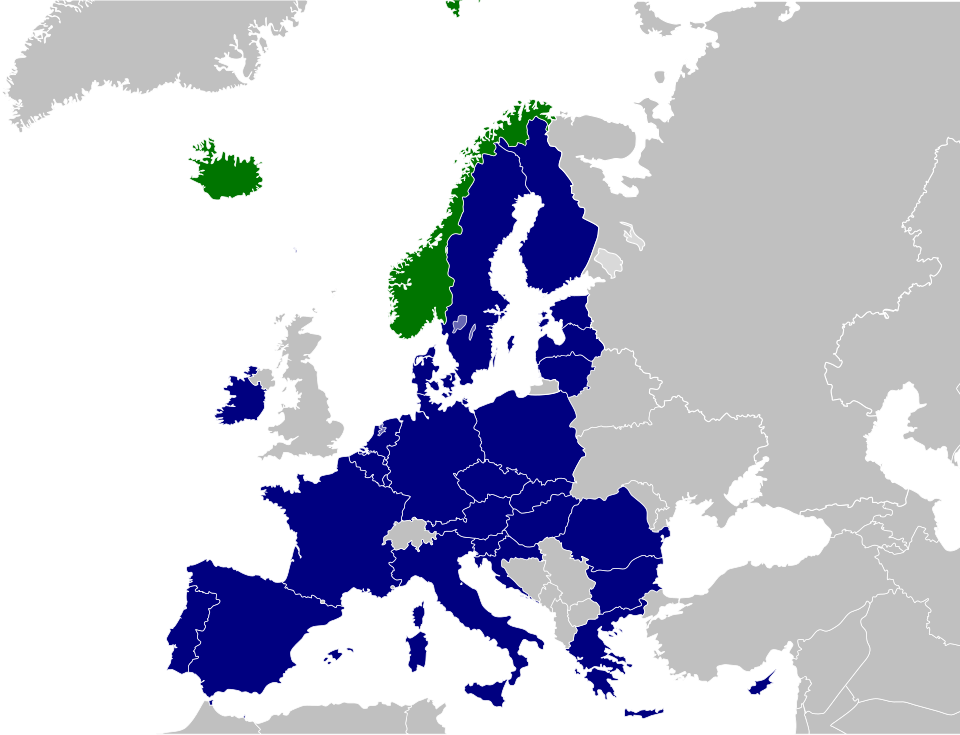

Slovak Prime Minister Robert Fico has called the EU’s plan to completely cut off Russian gas “energy suicide.” It could hardly be more accurate.

After four years of crisis, Europe has learned nothing and is continuing on the same path at a faster pace. Even more ironic is that this self-destruction is presented as a brave geopolitical stand (for in deapth analysis please also read the article titled “The US Energy Monopoly to the EU: Energy Security or Economic Suicide of the EU“).

The historian Arnold Toynbee noted that civilizations are rarely destroyed by external enemies; they usually commit suicide. Of course, no one consciously chooses decline.

And yet, Europe continues to consider its “decoupling” from Russian gas a success, pinning its hopes on a “green transition” that is unraveling before our eyes.

It is no coincidence that the peak of optimism about the energy transition – culminating in the Green New Deal in 2019 – coincided precisely with the peak of Russian gas supplies to Europe.

Germany’s ability to massively subsidize renewables for two decades was based on the energy surplus provided by cheap Russian gas. “Green luxury” was a derivative of cheap energy, not a substitute for it.

The False Doctrine of Brussels

The Spanish philosopher Jose Ortega y Gasset distinguished ideas from beliefs. Ideas are debated and changed – beliefs are invisible and structure thinking.

Europe’s central belief is that administrative intelligence can overcome tangible physical constraints. If the right mix of policies, subsidies and regulations is found, reality will adjust. Europe is constantly debating policies, but rarely challenging the assumptions on which they are based.

A second belief is that the economic problem is primarily a problem of prices.

Most economic theories were formulated in an era when energy was cheap and abundant, and therefore “invisible”. Not because it didn’t matter, but because its cost did not impose constraints on economic growth.

These very assumptions led Europe into the crisis and then determined the response to it.

Cost redistribution instead of a solution

In 2022, prices skyrocketed to over 300 euros/MWh. The answer was not to reduce energy costs, but to redistribute them irrationally: caps, tariff freezes, one-off taxes, subsidies.

A huge administrative system was deployed not to make energy cheaper, but to hide who was paying the bill.

The shift to LNG followed. New terminals, new interconnections, long-term contracts at higher prices. LNG yields less clean energy than pipeline gas and requires energy-intensive liquefaction and transportation processes. The costs are enormous, multi-year and largely financed by debt. It does not disappear; it is postponed to the future.

Four years later, prices may have fallen, but the crisis continues. Energy is now structurally more expensive and the policy responses remain the same: subsidies, exemptions, temporary relief. Germany proposes subsidized “industrial electricity prices”.

Italy establishes fixed low prices for industry in exchange for commitments on production costs. The pattern is clear: a game of cost transfer that is certainly not decreasing…

The financial system and bureaucracies are extremely effective at hiding physical reality. Stock market prices show market costs, not the real costs of the energy system nor how many real resources it absorbs.

Energy is measured by… energy

It takes energy to produce energy. This is a non-negotiable fact. No financial invention can change the energy balance.

If it takes almost one unit of energy to produce one unit of energy, there is no surplus – even the most uninitiated in the markets understands this.

When energy becomes more expensive in real terms, the system does not “spot” it in one place.

It sees it everywhere: lower productivity, deindustrialization, shrinkage. Everything is operating on consistently worse terms.

The key concept is ECoE (energy cost of energy). The more of the energy surplus is consumed to obtain the same amount of energy, the less is left for the economy. This is exactly what Europe is experiencing today.

The illusion of “normalization”

Bloomberg noted in a report that gas prices have returned to around €27/MWh, but the competitiveness of the European economy has not recovered.

The telltale detail is that consumption is about 20% lower than pre-2022 levels.

This is not stability. It is a demand collapse. Prices fell because energy-intensive industry left. And when industry leaves, it doesn’t come back.

Giants like BASF, Dow and Thyssenkrupp are not threatening to leave. They have already left – fully or partially.

The cultural limit of regulating developments

The Bruegel think tank argues that as RES increase, prices will fall. But the text itself admits that fixed costs are skyrocketing: networks, interconnections, subsidies, state mediation.

Costs are not reduced; they are simply… removed from the headlines. As the epistemologist Thomas Kuhn pointed out, a scientific paradigm determines not only the answers, but also the questions that are allowed to be asked.

Europe asks whether prices will fall. It does not ask how much of its economic output is now absorbed by energy.

The belief that Europe can “design” the overcoming of natural limitations is the core of European… ideology, perhaps even paranoia.

But no policy suspends the laws of thermodynamics by decree. Vaclav Smil shows that every successful energy transition has increased the energy density and productivity of the system. This is the test that Europe is failing.

Finally, as Joseph Tainter warned, increasing complexity is increasingly ineffective. In Europe, the solutions are extremely complex – but the results are meager and the future is bleak.