In 2019, the GDP of Greece (at constant 2015 prices, i.e. without inflation), was €183,777 billion at the end of 2019 and reached €194,494 billion at the end of 2023 – so it increased by €10,717 billion (HELSTAT data). That is, €50.508 billion in loans entered our economy and increased the GDP by €10.717 billion – therefore, for every €1 in loans, the Greek economy achieved approximately €0.21 in real growth.

We always refer to the debt of the central administration – that is, the money that the Greek state really owes at home and abroad. This debt, from €356.014 billion at the end of 2019 reached €406.532 billion at the end of 2023 – thus increasing by €50.508 billion in four years.

The hourly wage of shame

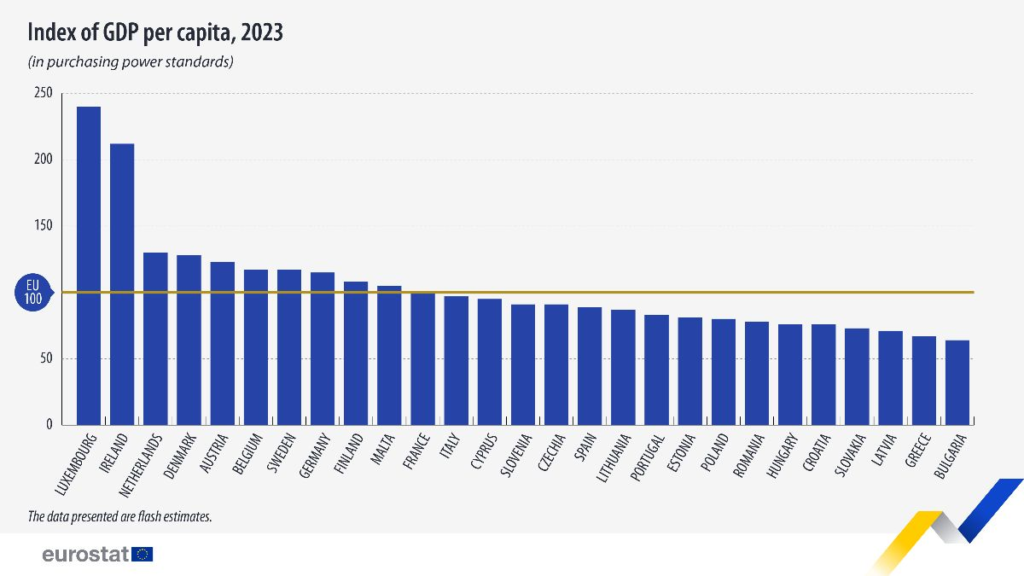

The hourly wage of Greeks in terms of purchasing power – proving that we are now last in the EU, behind even Bulgaria. Even worse, it proves that it has been happening since 2021 – so that, unfortunately, this situation is entrenched, it is a structural problem and the trend is downwards.

Simply put, it proves that Greeks have to work much harder than other Europeans to survive – for example, 25 days more per year than the Portuguese. However, every worker in the private sector can confirm this empirically – while if we add here the rest of the working conditions in Greece, the picture will become even darker.

But why does this happen? Apparently due to very low labor productivity – noting that, according to the latest figures from 2021, each employed person in Greece produced a value of €23,000 per year, compared to €60,200 in the EU, so it was at 38.3% of the average! So in a way, to cover the distance he would have to work 2.6 times more than the average European – or his salary would be 2.6 times lower!

So the problem of low hourly wages is directly related to labor productivity which in turn depends on investments – which increase productivity, therefore competitiveness.

However, serious investments in domestic production are not made in Greece – because

- Citizens do not trust the State,

- Justice is not working properly,

- the admittedly corrupt public sector is not functioning properly,

- overtaxation is scary,

- viable credits from banks are not provided,

- the Greek state only subsidizes tourism and wind turbines/photovoltaics (tax payers also subsidize wind turbines/photovoltaics through electricity bills)

The Minister of Economy, K. Hatzidakis, presented without a trace of shame the disposable income of the Greeks – a table that essentially includes all the incomes of workers from all sources and not just wages (allowances, etc.). Why did he do it? Obviously to mislead the Greeks – which is extremely dangerous, since when a government embellishes the facts for the sake of manipulating the voters, it is never going to solve them.

In any case, the new jobs created correspond to lower wages and relatively longer working hours – until workers can no longer cope with ever-lower real wages (=minus inflation), as well as increasingly long working hours (Greeks are already leaving the country en masse), so the Greek economy will collapse.

The scourge of “expensive cost of life”

The biggest problem of Greeks today is punctuality – but not of Greece, at least as far as its government is concerned. Why this differentiation? Simply because the rise in prices

(a) increases government tax revenue, reducing the budget deficit and

(b) lowers the debt-to-inflationary GDP ratio.

So it is no coincidence that only these two indicators are the pride of the economy minister K. Hatzidakis, the liquidator of Greece, who is certainly not interested in the Citizens – since all other economic indicators are in the deep red.

For Greeks now the high cost of living, clearly much higher than the statistics (CPI) for low and middle incomes, is literally deadly – while it is clearly visible in their per capita income, in terms of purchasing power.

In particular, after the alleged end of the economic support and stability programs* and despite the positive growth rates since then (with the exception of the huge recession of 2020), Greece has managed to cover only one unit of distance from the EU average: from 66 % in 2018 to 67% in 2023. By contrast, Bulgaria covered thirteen points, from 51% to 64% – so it will soon overtake Greece, just as Croatia overtook it in 2019.

But according to Eurostat, from 2018 to 2023 the population of Greece has decreased by 3%** – while the population of the EU has increased by 0.6%. Therefore, the inability to increase GDP per capita cannot be due to population growth.

Turning now to the price index of final household consumption expenditure, from which purchasing power units are calculated, again according to Eurostat it was at 86.8% of the EU average in 2018, rising to 88.2% in 2023 – so Greece’s accuracy was higher than the EU average (which continues in 2024).

This is how wealthy Greece ended up converging with impoverished Bulgaria instead of the EU, being in penultimate place – and soon in last place, if Greece’s economic policy does not change immediately.

Also, if the “beautification” of the apportionment by K. Hatzidakis and his government does not stop – with the disposable income and all other nonsense. After all, if one does not see things coldly as they are and is willingly blind, one is never going to improve them – on the contrary, they will constantly get worse.

Greece at the bottom of the “economic barrel”

“Greater than the outflow of wealth to the societies and economies of the EU and the USA in particular, is the de facto brain drain of Greece’s greatest capital: its people who unfortunately constitute Greece’s first “export product”.

It is a haemorrhage, the enormous value of which is being reaped by creditors – without, of course, reducing the debt, making Greece poorer and at the same time perpetuating its status of mediocrity.

On the other hand the parasitic, to some extent sociopathic economic and political elite continues to gobble up the loans and any other capital that enters the country – enriching itself without creating social wealth” (SLP). The flight from Greece of 1,080,000 citizens from 2010 to 2022, 10% of its population (GDP outflow of about €50 billion) and 159,000 in 2023 (graph), is perhaps the most painful result of the rolling bankruptcy – in which the domestic economic and political elite condemned the Greeks in order not to lose their privileges, apparently completely disregarding everyone else.

Unfortunately, it is not happening, nor is there a plan/vision for something like this – so the outlook for the Greek economy is depressing, no matter how optimistic one is. But the Greek immigrants are certainly aware of this fact – so they will never return, no matter how much they want to. Are there solutions? Of course, but not as long as the economic-political and parasitic elite – the economic (supported by politics) with its profiteering, with the cartels, with the “implementation” of the EU development programs, etc. it doesn’t exist – since Greece is now at the bottom of the “economic barrel”!