De-dollarization is a historical process that seeks to end US hegemony in global trade and financial transactions by shifting to alternative methods of transactions, such as national currencies and regional payment systems. 1/3 of UN member states have already opted for de-dollarization and decided to rely on national currencies to make payments.

Representatives of at least 68 UN countries have openly supported the de-dollarization process or said they have taken steps to that end. The most determined voices to replace the dollar with national currencies have come from politicians whose countries are members of major regional organizations such as the Association of Southeast Asian Nations (ASEAN) and BRICS, which originally included Brazil, Russia, India, China and South Africa – but expanded to include a number of other countries on 1 January.

Trying to create a strong front against the dollar

For his part, Brazilian President Luiz Inacio Lula da Silva has repeatedly proposed the creation of an alternative currency to the dollar for interstate transactions within the BRICS. His position is shared by South Africa’s finance minister, Enoch Godongwana, who called for a boost to lending in national currencies. Also joining the anti-dollar front was Kenyan President William Ruto, who urged local leaders to take the first steps toward abandoning the dollar and transacting through the pan-African payment system. Many countries have already realized the fact that the dollar is a threat to them not only as a means of payment, but also as a global reserve currency, so the concept of de-dollarization should be considered more widely by them.

The example of Israel

Israel, for example, announced earlier that it would reduce the dollar’s share of the country’s foreign exchange reserves in favor of the Chinese yuan. Some countries are making more targeted efforts to reduce their population’s dependence on foreign currencies, including Vietnam, which has banned long-term foreign currency deposits.

De-dollarization is one of the consequences of the increasing fragmentation of the world economy and the transition to a multipolar world. De-dollarization intensified due to the anti-Russian sanctions, which clearly showed the dangers of the national economy’s dependence on the American currency. De-dollarization reduces the demand for the dollar and thus contributes to its depreciation.

Retreat of the dollar

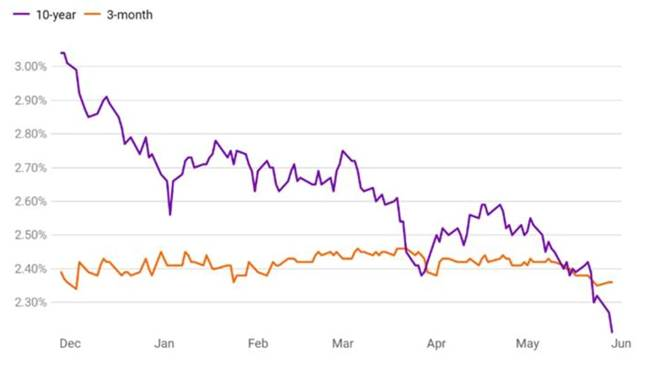

The potentially unlimited range of cooperation between the Eurasian Economic Union (EEU) and ASEAN aspires to reach new levels, and it is especially important to accelerate the transition to national currencies, Russian officials believe. The dollar fell 2.7% against other major global currencies in 2023, the US currency’s worst year since the 2020 coronavirus-related global economic recession.

The stability of the USA is being shaken

The world has growing concerns about the stability of the US and its ability to meet its debt obligations. The Saudis, who have been relied on for 50 years to maintain demand for the US dollar as the world’s reserve currency, had announced they were joining BRICS, the international coalition of Brazil, Russia, India, China, South Africa.

Egypt, Ethiopia, Iran, Saudi Arabia and the United Arab Emirates joined on the same day. If that wasn’t enough, now the Biden administration is considering a policy that can only worsen de-dollarization.

The United States and the G-7 are “actively exploring ways to seize assets of the Russian central bank” in their countries to finance the war in Ukraine, because political opposition to continued support of Ukraine in the United States and Europe threatens the flow money that kept Ukraine alive.

G7 members and other specially affected states could seize Russian sovereign assets as a countermeasure to induce Russia to end its aggression.

Such a seizure of Russian assets (please read the analysis titled “The theft of Russian assets by the G7 “damages the prestige” of the euro & dollar as “safe currencies“) would raise doubts among other countries that their investments in US bonds, markets and financial institutions could be seized by the United States in a political dispute.

The US’s “excessive leverage” has allowed it to accumulate extraordinary levels of debt in exchange for, essentially, the securities it has given to its creditors. And given their level of debt, and especially their debt-to-GDP ratio, their trading partners are now questioning their ability to repay it, as is any other creditor.

In addition to this fiscal environment, actors from foreign countries seeking to undermine the United States for their own geopolitical advantage, particularly China, are actively pursuing efforts to undermine the US dollar as the global reserve currency. Part of their strategy is to close transactions in their own currencies.

The US dollar is under attack from the global market

While the US continues to enjoy the largest, most transparent and best-regulated capital markets in the free world and the largest per capita consumer market, other elements of the dollar’s supremacy are eroding.

Its status as the world’s reserve currency – its “excessive privilege” – is unlikely to last well into the next decade. This will have huge negative consequences for American citizens. Interest rates needed to finance US debt would skyrocket, shutting out other alternative, productive investment in business and innovation.

Congress absolutely needs to manage spending, make deep, real cuts, and have the courage to raise taxes mostly on its own donor class to get to a balanced budget by 2030 at the latest. If not they do, the day will come when the value of the dollar will shrink drastically.